|

|

Children's Clothing

Children's Clothing

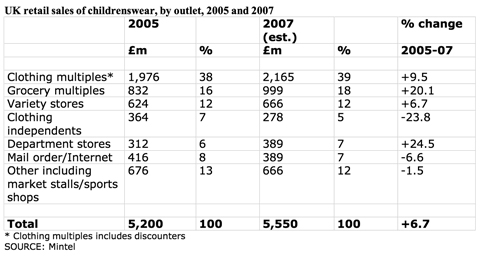

Although clothing specialists are still the principal channel for childrenswear, they are facing stiff competition from the grocery multiples.

The market is currently worth £5.5 billion, a 21% growth since 2002. Clothing specialists account for 39% of the market compared with the supermarkets' 18% share. But the real story lies in the growth figures.

The supermarkets grew their share last year by an impressive 21%, growing at twice the pace of the clothing multiples who saw a 10% year on year increase. This was second only to department stores at 25%. Meanwhile clothing independents dropped by 24%.

Supermarket clothing ranges now offer a legitimate alternative to high street standards, reflecting the latest styles at very competitive prices. The major players have successfully created affordable fashion lines that are now recognisable brand names. Many are also branching out beyond the basics to offer school uniforms, all in, at under £10.

Ultimately the convenience and ease for busy mum's to combine children's clothes shopping with their weekly shop is key, and remains one of the driving forces behind the supermarkets success. Indeed Mintel's exclusive consumer research can reveal that over half of those who bought childrenswear in the last year often pick up something while on a supermarket trip. For them, childrenswear shopping is now more spontaneous.

With many grocery multiples adding more retail clothing space to new stores there will undoubtedly be even stronger growth in the future. Mintel forecasts a steady 15% growth in this market to 2012, resulting in an estimated worth of £6.4 billion.

Convenience Store Retailing

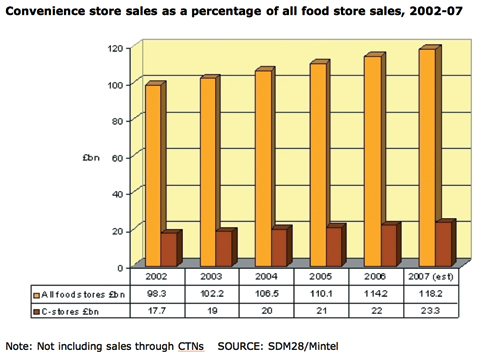

Consumer shopping habits are changing. Many are planning ahead less and shopping has become more fragmented. Because of this shift, and higher standards, the convenience retail sector is a buoyant market and has grown its share of food retailing over the last five years. According to Mintel, retail sales through convenience stores have grown by £5.6 billion over the last five years. Indeed sales have grown faster through convenience stores than through food retailing as a whole, during this time. The market is currently worth £23.3billion.

Over half of all adults claim to buy from convenience stores at least once a week, so foot traffic is huge. The most frequent users are under-35s. Half of users say they go 'if I need something straight away', while 39% say they 'use for top up items between shops', demonstrating that whilst convenience stores are not serving the main shopping needs they do play an important weekly role.

Symbol group retail sales still account for the largest share, at £7.5 billion, representing 32% share of the market. Store improvements and the rush to become more competitive have driven this.

Sales in multiples are just behind this with 31% share. They are expanding significantly, adding many more outlets and taking over some smaller groups.

Mintel forecast continued growth for retail sales through convenience stores, 28% to 2012, to reach an estimated £29.8 billion. A growth in smaller households, who have less of a tendency to bulk buy will fuel this. These households will grow faster than other sized households.

Edible Oils

Edible Oils

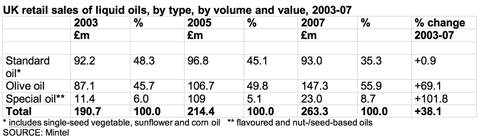

The edible oils market is split into solid and liquid oils. In 2007 the market was worth £276 million. The continued trend of consumers trading up from vegetable oils to olive oil is sustaining rapid growth within the market, up 40% between 2002-07.

Solid oils are becoming increasingly out of step with modern cooking trends. Down 22% in the last four years (03-07) this market is now worth £12.6million; compared to the liquid oils market which is worth £263 million, up 38% over the same period.

Within the liquids market, speciality and olive oils are growing in popularity due to their perceived health benefits. There has been a noticeable downward trend in vegetable oil sales. Sunflower oil has fared better with some premium development, notably organic variants. Groundnut and sesame oils are becoming popular due to an increase in ethnic cooking, although this remains a niche market.

Extensive product line-ups have fuelled growth for grocery multiples. Independents have been able to sustain value due to their showcasing regional olive oils, and locally produced specialist seed oils.

Retail sales of edible oils are expected to grow a further 49% by 2012. With extra virgin oils driving value in the market, a steady stream of premium and added value launches is expected to fuel this growth.

Ice Cream

Ice Cream

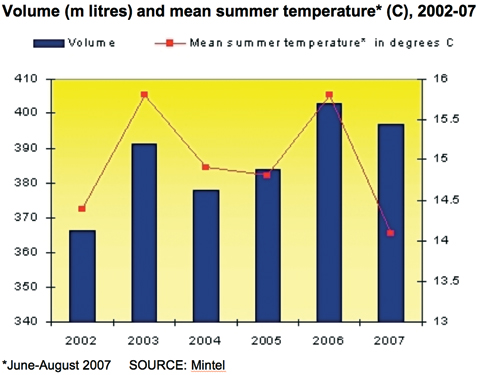

The ice cream market is worth an estimated £1.25 billion in 2007, a rise of 8% since 2002. However, the market is still at the mercy of the weather and reached a high of £1.33 billion in 2006 due to a hot summer. The poor summer of 2007 meant these sales could not be maintained, and value has dropped by 6.6%.

Volume sales in 2007 reached 397 million litres, a growth of 9%, partly achieved through significant discounting. This growth is especially significant as it has been achieved in a mature market, and in the wider context of declining frozen sales.

The price per litre of ice cream has remained broadly stable, seeing a peak in 2006 due to an increase of premium lines and a general up-spend. However, heavy promotions have taken their toll and, in 2007, price has fallen as brands and retailers used promotions to counteract any dip in volume sales.

Mintel forecasts 7% growth in value for the total ice cream market to 2012, resulting in an estimated worth of £1.3 billion.

Our volume forecasts show similar growth to value of the market, growing by 8% into 2012. We can infer from this that average price per litre will remain relatively stable.

The introduction of farmers' markets and specialist fairs has boosted the independent sector. However, multiples dominate the market increasingly and now account for 80% of take-home sales. Freezer centres are showing a decline, as consumer footfall at these stores continues to fall.

Noodles

Sales of noodles increased in value by 15% between 2002 and 2007 to reach £191 million. Consumers have been attracted by their convenience and healthy status, as well as benefiting from the growing trend in stir- fry style cooking.

Snacking noodles account for half of market value in 2007, followed by savoury (23%) and ambient plain noodles (14%). Chilled noodles and chilled noodle-based ready meals each account for 6% of market value, while frozen ready meals make up the remaining 1%.

Ready-to-cook noodles have been the focus of growth. New introductions have appealed to those consumers looking for a quick and convenient meal solution, since they dispense with the need to soak or boil. They also offer several benefits over chilled including the fact they have a comparatively long shelf life and are available in several different types.

Dry noodles are fast becoming the poor relation of the sector as consumers increasingly trade up to higher-value ambient wet products. The introduction of rice noodles has offered some hope, but currently represent only a tiny niche - equivalent to less than 1% of traditional plain noodles

Mintel's exclusive consumer research finds many UK consumers remain unsure about eating noodles. Barely half of adults eat noodles, compared with more than seven in ten adults who eat pasta. However, consumption is strongly linked to age with younger consumers being more adventurous. Nonetheless the market looks set to grow as consumers buy into the health and convenience of noodles. Mintel forecasts a 35% growth to 2012 with a market value of £258 million.

Value Clothing

The popularity of 'cheap chic' clothing among a broad consumer base, and significant retail space growth have seen the value clothing market grow massively in recent years.

While the clothing market has grown by 18.5% since 2002, the value clothing market has grown by nearly 37%. The market is currently worth £7.2 billion according to Mintel figures.

The supermarkets and Primark are driving this growth. Whilst the specialist clothing retailers saw a 5% year on year increase in 2007, the supermarkets increased their year on year takings by almost 7%. All are adding significant space through new stores, which will undoubtedly drive sales.

Mintel's exclusive consumer research shows only 15% of Britons are concerned about the cheap labour conditions that are behind producing value clothing. With 30% of adults saying they want to pay as little as possible for clothing, it's clear where the priorities of the British shopper lies. Indeed with 36% buying all their basics from value ranges it seems value shopping is a way of life for many.

Looking to the future, the value clothing market will continue to grow, but at a slower rate than previously. Partly, this will be because of less space growth in 2008, but also due to ongoing intense competition.

Taking this into account, Mintel forecasts steady growth for the UK value clothing market, with a growth of 38% from 2007-12, resulting in an estimated worth of £8.7 billion.

|

|

|

|

Back to top

Rice

Rice

Mintel values the rice market at £269 million in 2007, up 59% since 2002. Mintel forecasts that the UK rice market will grow by an estimated 24% over the period 2007-12.

Dry rice continues to be the biggest sector, however, the industry believes the microwave sector will overtake in the next 12 months.

Convenience is a key driver for consumers with the 84% growth in ambient microwave pouches. In addition the 20% growth in the chilled and frozen category is driven by the chilled sector with the frozen sector experiencing decline. Chilled is both more convenient and often perceived as healthier and more premium. Chilled rice accounts for £20 million. Frozen rice, at an estimated £4 million in 2007 has seen a gradual decline in sales.

The pudding and ground rice segment of the market has seen its values stagnate. This is despite resurgence in home cooking and an increasing proportion of over-65s in the UK population, who typically show a preference for these types of rice. However, with consumer health awareness growing, such stodgy and sweet recipes no longer find favour.

All trade channels are benefiting from increases in microwave sales. Multiple grocers have sought to offer a more competitive range where they were previously losing out on the ethnic pound to specialist shops.

Almost a third of consumers eat rice as a healthy option, with 10% eating more rice than potatoes and 20% of consumers cooking a lot of dishes with rice.

Alcohol Special

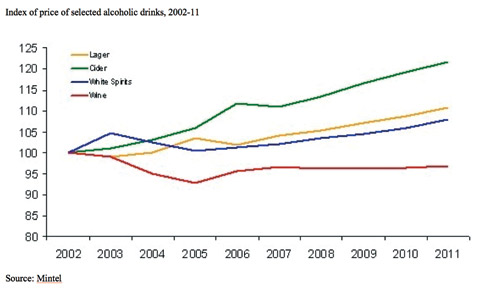

Due to increased government pressure and concerns over health, consumers are drinking less alcohol, leading to a slow down in volume sales.

Sectors that have achieved a higher proportion of sales in the premium segment, e.g. cider, are showing value growth, or holding off market decline like the white spirit sector, particularly vodka.

However sectors like wine and beer, that have focused on growing volumes through discounting off-trade have struggled to increase market value. The total alcohol market is currently worth £25 million

Lager is currently worth £10.8 million, with sales slowly declining (4% decrease in two years). Volume has declined by 187 million litres over the past two years. The industry has responded with intense NPD but Mintel predicts that both volume and value sales will continue to decline.

The wine sector is showing slow but consistent growth in terms of volume, but for the most part does not seem to be able to switch the consumer to higher value products. Value sales grew by 3% in the last year, volume by just 2%. The champagne and sparkling wine market grew by 7% in volume terms and slightly less in value terms, and for many represents a growth area of the wine market

The real market winner is cider, having seen a 10% increase in volume sales and 17% in value. Changing tastes and premiumisation have led to the success in this category.

In order to avoid further down turn, the alcohol industry will need to grow value, away from the traditional model of selling more products to stimulate revenue.

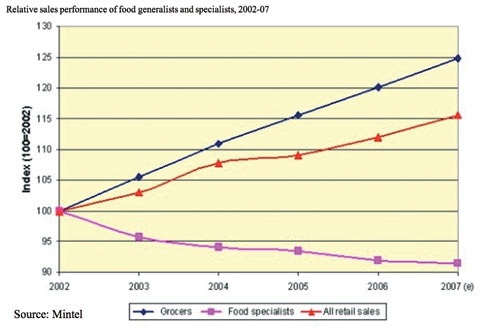

Food Retailing

Food retailer sales grew by 17% between 2002 and 2007 to reach £110 billion excluding VAT. The faster growth, and often higher margins, of non-food products has driven the multiples to develop these ranges.

Over the last 12 months, inflation has driven prices up, and while some of the increases have been absorbed by the retailers’ margins, some have been passed on to consumers.

But despite price pressures, the food and drink market has been a solid performer in the last five years. Value added products like ready prepared meals, organic foods, speciality, local and premium ranges are driving the market.

Speciality food stores, delicatessens, farm shops and farmers markets are enjoying a revival as British consumers develop a taste for better quality, fresher, more natural and more local foods.

Non-alcoholic drinks have grown fast, but remain a fairly small market segment so have less impact. Alcohol and tobacco have been the sluggish performers. Beer sales have been in slow decline, impacting on overall sales of alcoholic drinks. Tobacco prices have risen because of steady tax increases imposed under the government’s anti-smoking policy, but consumers trading down or giving up smoking have hampered value growth.

With little let up on food inflation likely, this presents a more challenging environment for food retailers in the months ahead. Mintel predicts however that food retailers will continue to capture a rising share of all retail sales albeit at a slower pace.

Italian Foods

The Italian foods market has grown by 30% since 2002 and is worth £2 billion. The biggest sectors driving growth in the market are pizza, pasta and pasta sauces.

The pizza category occupies the biggest share of the market at 33%, worth £688 million. The recent growth in value is due to both price increases and volume growth. This has been driven by the introduction of more premium chilled and authentic recipes and one-person portions.

Pasta and pasta based meals are worth £493 million. The pasta market has shown continued growth as it satisfies two major consumer needs: convenience and health. Although pasta-based meals are dominant, particularly chilled ready meals, fresh pasta has been the star performer, increasing by almost 56% since 2001.

After stagnating up to 2004, sales of pasta sauces have recovered, and are now worth £338 million. The premium sector has been thriving, with many consumers trading up to more authentic sauces, often perceived to be healthier than their standard counterparts.

Multiple grocers offer convenience, both in the form of a one-stop shop and via Internet shopping. Mintel estimates that grocers' online sales stood at £2.2 billion in 2006.

Ease of cooking is the key driver of Italian food, followed by its healthy perception and position as a family favourite. The category is set to grow by 23% to 2012 based on its credentials of variety, authenticity and health. Mintel forecasts an estimated value of £2.6 billion by 2012.

Baby Food, Drinks And Milk

Sales of baby milks, food and drinks increased by 36% from 2002 to 2007 to reach £392 million.

Overall, baby meals have seen 12.5% growth since 2002 from a £128 million to £142 million this year. Wet meals have enjoyed 20% growth over the last five years largely due to new product development and the growth in organic meals.

Milks have experienced good growth rates over the past five years, from £131 million in 2002 to £203 million in 2007. First- and second-stage powders, suitable for babies from birth to six months, account for the majority of milk sales. RTF milk, popular due to their convenience, represents the biggest growth category in the market (75% increase between 02-07).

Baby drinks have fallen from favour following adverse publicity regarding their high sugar content, with sales remaining stagnant since 2002 at £15.5 million.

Increasingly, parents are using the leading grocers as a one-stop shop for all their baby needs. Other retailers have found it difficult to compete against retailer-led price competition between the grocery multiples.

More than half of parents agree that baby foods can become quite expensive, and one in five buy whatever is on special offer, and would like to see greater choice on offer. A third of parents say they would buy products that offered extra fortification such as added iron or calcium.

Mintel forecasts that the UK baby food and drinks market will grow by an estimated 19% between 2007 and 2012 to £469 million.

Organic Foods

In 2007, the market for organic food is worth an estimated £1.5 billion, having increased by 70% since 2002. Increased product availability and rising consumer interest in health and premium food markets have fuelled sales.

Fruit and vegetables comprise the largest sector of organic foods at £502 million. They remain the most frequently bought category of organics - and for many the entry point to the market.

Retail sales of organic dairy products have more than doubled over the last five years, now worth £310 million. The success in the sector rests on strong branding, high levels of NPD activity, quality products, wide availability and price-competitiveness with non-organic produce.

A maturing organics market has seen high growth in frozen, chilled and convenience products. Consumers are now familiar with organics in the fresh aisles and now seek the same quality in prepared foods across ambient, chilled and frozen sectors.

Sales of organic meat have benefited from rising demand for premium meats and consumer interest in higher production values such as 'farm assured'. Food safety scares have prompted consumers to seek greater reassurance about the quality of the meat they buy.

Box schemes and mail order have seen greatest growth and multiples have been quick to start their own box schemes. Independents have little presence outside of London as yet.

Health is the main incentive to buy with cost the most cited deterrent. Provenance and local sourcing are more important to heavy organic purchasers.

Mintel forecasts the organic food market it is set to grow by over 54%, from 2007-12, estimating the market to be worth £2.3 billion.

|

|

|

|

|

|

View Mintel Reports by issue date

|

|

|

|

|